At Finalert, we offer comprehensive Payroll Processing Services that help businesses manage their payroll operations with precision, security, and compliance.

Payroll errors, late salary payments, and incorrect tax deductions can lead to employee dissatisfaction and legal penalties. Our automated payroll solutions eliminate these risks by ensuring timely salary disbursement, accurate tax deductions, and seamless compliance with labor laws.

Managing payroll efficiently is vital – 54% of U.S. employees experience paycheck errors annually and 45% of companies experience at least one payroll error each year, highlighting widespread inconsistencies. At Finalert, we offer end-to-end Payroll solutions, ensuring precise salary payments, accurate tax deductions and full compliance with federal, state, and local labour laws.

Payroll can be complex, involving calculations for salaries, bonuses and taxes. Businesses often encounter manual errors, misclassifications, and evolving tax rules. Approximately 40% of small businesses are penalised annually for payroll tax inaccuracies, averaging $845 in IRS penalties. Our advanced payroll solutions automate salary calculations, tax withholdings, and payment runs, dramatically reducing risk.

Outsourcing isn’t just convenient—it’s trusted. About 45% of small U.S. businesses outsource payroll, saving time, reducing errors and focusing on core operations. By partnering with Finalert, you gain access to specialised expertise, robust compliance, secure data handling and peace of mind – ensuring your team is paid accurately, timely and trouble-free.

Finalert is recognised as one of the top payroll companies in the U.S. We pride ourselves on delivering accurate, responsive, efficient and compliant payroll solutions tailored to meet the evolving requirements of modern businesses.

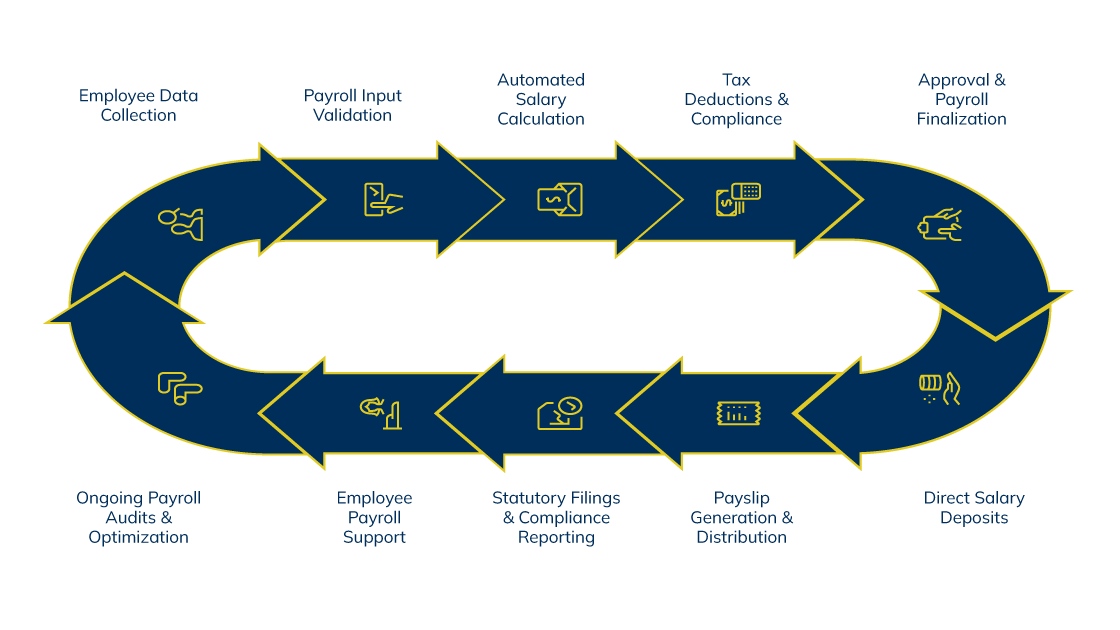

Our structured Payroll Processing Workflow is designed to reduce manual errors, improve turnaround time and ensure full regulatory compliance. By combining advanced automation with expert validation, we streamline payroll management from start to finish.

We gather essential information, including salary details, tax codes, and employee benefits, to build a solid payroll foundation.

All working hours, leave balances and salary structures are carefully verified to ensure data integrity.

Using contract terms, allowances, bonuses and deductions, our system accurately calculates each employee’s net salary.

We calculate and deduct the correct amounts for income tax, National Insurance, pensions and other statutory obligations.

Final payroll reports are reviewed and approved before processing to ensure complete accuracy.

Salaries are securely transferred to employees’ bank accounts via direct deposit, ensuring timely payments.

Our team handles all payroll-related tax filings and submits necessary documents to HMRC and other regulatory bodies.

We generate digital or printed payslips with clear breakdowns of salary and deductions for each employee, ensuring transparency and accuracy.

We assist employees with payroll-related queries and tax documentation requests.

Regular payroll audits help ensure ongoing compliance, accuracy and opportunities for process improvement.

We gather essential information, including salary details, tax codes, and employee benefits, to build a solid payroll foundation.

All working hours, leave balances and salary structures are carefully verified to ensure data integrity.

Using contract terms, allowances, bonuses and deductions, our system accurately calculates each employee’s net salary.

We calculate and deduct the correct amounts for income tax, National Insurance, pensions and other statutory obligations.

Final payroll reports are reviewed and approved before processing to ensure complete accuracy.

Salaries are securely transferred to employees’ bank accounts via direct deposit, ensuring timely payments.

Our team handles all payroll-related tax filings and submits necessary documents to HMRC and other regulatory bodies.

We generate digital or printed payslips with clear breakdowns of salary and deductions for each employee, ensuring transparency and accuracy.

We assist employees with payroll-related queries and tax documentation requests.

Regular payroll audits help ensure ongoing compliance, accuracy and opportunities for process improvement.

Efficient payroll matters – One in five payrolls in the United States contains errors, each costing an average of $291. At Finalert, we’re proud to offer the best payroll service for small business and established brands, offering a structured, automated workflow that ensures accuracy, speed and full compliance with federal and state regulations.

From employee data verification to direct deposit, our end‑to‑end process eliminates expensive mistakes. Finalert positions your company to benefit from expert handling, increased efficiency and proactive compliance.

We collate essential information, including salary, tax codes and benefits, to build a reliable payroll dataset.

Every working hour, leave record and salary structure undergoes thorough verification for data integrity.

Our systems compute accurate net pay using contracts, bonuses, deductions and overtime rules.

We handle precise calculations for income tax, Social Security, Medicare and insurance, minimising IRS penalties.

An expert team reviews payroll data before final approval, ensuring error-free processing.

Employee pay is securely transferred via direct deposit; 93% of U.S. workers favour this payment method.

Payslips; digital or printed; with transparent breakdowns are provided to each employee.

Our dedicated team handles enquiries, clarifies deductions and issues tax forms.

Regular audits keep your payroll compliant, accurate and continuously improved.

We prepare and submit payroll-related filings, tax returns, and regulatory documentation in a timely and accurate manner.

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert serves U.S. foundations, charities, associations, and mission-driven organizat…

Finalert provides comprehensive accounting, cost management, and financial advisory ser…

Finalert delivers specialized accounting, tax planning, and financial advisory services…

Finalert provides specialized accounting and financial advisory services to U.S. media…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

No results available

At Finalert, our approach to payroll processing is rooted in accuracy, security and full compliance. We harness the power of AI-driven payroll systems, automated tax handling and real-time reporting to ensure every payroll run is seamless, efficient and fully transparent.

By integrating secure payment gateways, automated workflows and intelligent compliance management tools, we help businesses significantly reduce manual errors, eliminate costly delays and maintain total visibility across every aspect of payroll.

Minimise errors and save time with automated calculations and intelligent scheduling.

Stay up to date with ever-evolving tax laws and industry-specific regulations.

Improve employee satisfaction with clear, timely payslips and self-service access.

Whether you’re a startup or an enterprise, we tailor solutions to your size and sector.

Use actionable insights to streamline processes and boost operational efficiency.

Get access to expert support whenever you need it - with guidance on compliance, tax and reporting.

Minimise errors and save time with automated calculations and intelligent scheduling.

Stay up to date with ever-evolving tax laws and industry-specific regulations.

Improve employee satisfaction with clear, timely payslips and self-service access.

Whether you’re a startup or an enterprise, we tailor solutions to your size and sector.

Use actionable insights to streamline processes and boost operational efficiency.

Get access to expert support whenever you need it - with guidance on compliance, tax and reporting.

Don’t take our word for it. Trust our customers

Finalert is an outstanding accounting, financial advisory and analytics company that delivers a wide range of services and solutions with the highest level of professionalism. Their expert team, with whom I have personally worked, possesses exceptional skills that enable customers to meet their financial and accounting needs seamlessly. Their dedication to excellence and customer satisfaction sets them apart, making them a trusted partner in the industry.

Finalert was hired to handle our payroll and pension administration. The process is extremely cost effective, and it has been extremely beneficial to us in terms of lowering our administrative costs and streamlining the payroll process.

For many years, as a medium-sized company, we had relied on a Big 4 firm to handle our audit and tax work. Following some service issues, it was decided to outsource that work to a local firm. I'm happy to report that the move has benefited us in terms of improved service and lower costs.

I have worked briefly with the Finalert team, who were tasked with cataloging validation rules for the ERP system. They did a very thorough job, ensuring the accuracy of information before implementing it. Additionally, their team was extremely responsive, often addressing any inquiries or requests within minutes. Their customer service skills are exceptional, and they were a pleasure to work with.

This FAQ section addresses common concerns about Payroll Processing Services, helping businesses understand how automated payroll management enhances efficiency, compliance, and accuracy.

Payroll Processing is the complete handling of salary calculations, tax deductions, and payments to employees, while ensuring compliance with labor laws. At Finalert, our payroll outsourcing services help businesses avoid late payments, incorrect deductions, and compliance errors. Accurate payroll processing is essential—errors in calculations or timing can lead to compliance issues and decreased employee trust. By using automation and expert validation, we deliver timely, accurate, and secure payroll operations, making payroll one less thing for businesses to worry about.

Automation eliminates manual errors, speeds up salary computations, and ensures accurate tax deductions. At Finalert, our automated payroll programs handle everything from time tracking to automated paycheck generation from working hour validation to payslip generation. This reduces delays, improves accuracy, and ensures seamless compliance with regulatory norms. Automated workflows also allow real-time monitoring, ensuring businesses get payroll done faster and with fewer risks. With automation in place, your team can stop worrying about spreadsheets and focus on growth, while payroll runs smoothly in the background.

Yes, Finalert fully manages tax withholdings and compliance as part of our payroll outsourcing services. We calculate and deduct income tax, social security, and insurance as required by law. Our process includes generating statutory filings and submitting regulatory documentation to keep businesses compliant. With expert validation and automated systems, we help clients avoid penalties and reduce risks. From accurate tax deductions to seamless filings, our payroll services ensure your business meets every legal requirement with ease.

Absolutely. At Finalert, our payroll programs are fully customizable based on your business size, industry, and workforce structure. Whether you need unique salary models, bonus structures, or tax configurations, we tailor the workflow to match your operations. Our flexible solutions ensure accuracy, transparency, and compliance, regardless of how simple or complex your payroll needs are. This adaptability allows businesses to scale confidently, knowing their payroll system can grow and change along with them without disrupting the process.

Yes, Finalert prioritizes payroll security at every step. We use encrypted systems and secure payment gateways to ensure safe salary transfers and data protection. Our process includes expert validation and periodic payroll audits to catch and correct any discrepancies. By automating sensitive workflows and limiting manual handling, we minimize risks and improve transparency. Businesses can count on Finalert to maintain the integrity of their payroll operations while always safeguarding confidential employee and financial data.

No results available

Would you like to speak to one of our consulting manager over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.

Open Hours

Find Us on

New York Office

Open Hours

Find Us on

Ready to thrive? Connect with Finalert today and let’s succeed together in the dynamic global market.

© 2025 Finalert. All rights reserved.

Ready to grow with confidence and clarity?

Finalert delivers high-quality accounting, financial advisory, and analytics services tailored to growing businesses providing control, visibility, and decision-ready insight to support sustainable success.

Address

Our Services

Accounting Services

Advisory Services

Industries

Quick Links

© 2026 Finalert® LLC. All Rights Reserved.