Whether you’re a busy founder in Ohio or managing payroll for a growing team in New York, Finalert takes the financial admin off your plate. Our expert bookkeepers give you real-time bookkeeping insights, clean records, and peace of mind, so you can focus on what really matters: growing your business.

At Finalert, we provide small businesses and startups with expert bookkeeping in accounting services that fit how you work, without the cost or complexity of hiring an in-house team. Our solutions are designed to take the stress out of financial admin, while giving you the clarity and confidence to grow.

We handle all the essentials: accounts receivable and payable, payroll, credit card and bank reconciliations, employee expense tracking, fixed asset accounting, sales tax filing, and timely financial reports. Everything stays clean, accurate, and audit-ready. So, you’re always one step ahead.

We also support strategic business bookkeeping services like project-based bookkeeping, budget planning, cash flow forecasting, and consolidated reporting. Whether you’re managing investor funds or preparing for expansion, we help you make decisions backed by real numbers.

We work closely with your team to keep your financials organised, up to date, and easy to understand. With real-time reporting, dedicated support, and tools that fit into your existing systems, our service gives you one less thing to worry about, so you can focus on building your business.

Did you know?

More than 60% of solo business owners say they’re unsure about handling their finances. And, 82% of small businesses fail because of poor cash flow management.

That’s why we’ve built a bookkeeping service that’s not only accurate — it’s accessible, real-time, and reliable.

Bookkeeping works quietly in the background, keeping your business financially strong. It tracks what’s coming in and going out, keeps everything tidy and compliant, and makes tax time simple. It is the foundation of bookkeeping in accounting and a key part of staying financially organised.

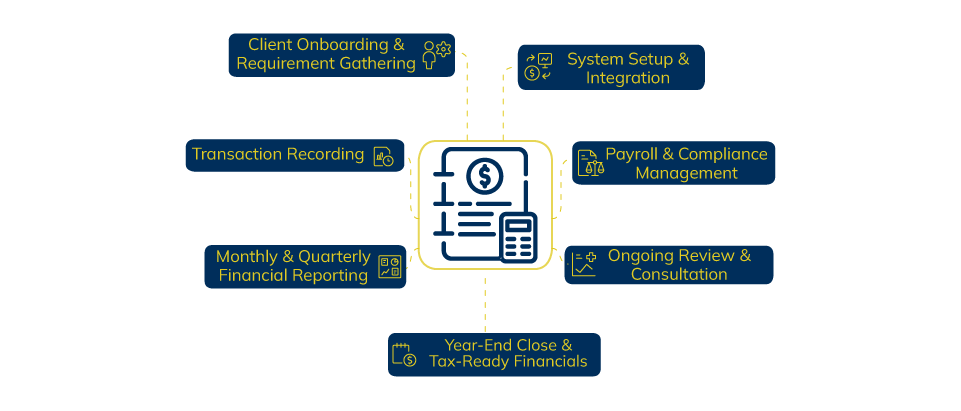

We do more than just manage your books. We create clarity, confidence, and consistency for your business. Here’s how we deliver expert bookkeeping support every step of the way:

We start by understanding your business model, financial setup, and challenges. Whether you’re a startup juggling invoices or an established firm with systems in place, we tailor our onboarding around what’s most important to you.

No two businesses are the same. Hence, we don’t use cookie-cutter solutions. We develop a bookkeeping strategy that aligns with your tools, team structure, and specific growth goals, ensuring efficiency from day one.

We securely connect all your financial tools — from bank accounts to apps like QuickBooks, Xero, or Stripe — so everything works smoothly together. You get accurate, real-time bookkeeping data without lifting a finger.

From recording daily transactions to reconciling accounts, our team handles the heavy lifting. You’ll have peace of mind knowing your books are always current and compliant without any stress on your side.

Each month, we deliver clear, concise reports that help you know exactly where your business stands. We walk through the numbers with you, so you're always in control and never left guessing.

As your business evolves, so do your financial needs. We continuously assess and optimise our processes, ensuring that your financial management adapts to changing circumstances. That’s why more startups are turning to outsourced bookkeeping for startups that grow with them.

We prioritise your privacy and data security. All your financial information is stored using bank-level encryption and cloud-based systems that meet the highest compliance standards.

Whether you're hiring new staff, adding new revenue streams, or expanding across states — our services scale with you. We adjust your plan as needed, so it always fits your business stage. This is where smart business bookkeeping services make a difference.

You’ll always have access to a dedicated account manager who knows your books inside out. Whether it’s a quick check-in or a detailed review, we're available when you need us — by phone, email, or Zoom.

We start by understanding your business model, financial setup, and challenges. Whether you’re a startup juggling invoices or an established firm with systems in place, we tailor our onboarding around what’s most important to you.

No two businesses are the same. Hence, we don’t use cookie-cutter solutions. We develop a bookkeeping strategy that aligns with your tools, team structure, and specific growth goals, ensuring efficiency from day one.

We securely connect all your financial tools — from bank accounts to apps like QuickBooks, Xero, or Stripe — so everything works smoothly together. You get accurate, real-time bookkeeping data without lifting a finger.

From recording daily transactions to reconciling accounts, our team handles the heavy lifting. You’ll have peace of mind knowing your books are always current and compliant without any stress on your side.

Each month, we deliver clear, concise reports that help you know exactly where your business stands. We walk through the numbers with you, so you're always in control and never left guessing.

As your business evolves, so do your financial needs. We continuously assess and optimise our processes, ensuring that your financial management adapts to changing circumstances. That’s why more startups are turning to outsourced bookkeeping for startups that grow with them.

We prioritise your privacy and data security. All your financial information is stored using bank-level encryption and cloud-based systems that meet the highest compliance standards.

Whether you're hiring new staff, adding new revenue streams, or expanding across states — our services scale with you. We adjust your plan as needed, so it always fits your business stage. This is where smart business bookkeeping services make a difference.

You’ll always have access to a dedicated account manager who knows your books inside out. Whether it’s a quick check-in or a detailed review, we're available when you need us — by phone, email, or Zoom.

At Finalert, we understand how busy small business owners are and how critical accurate financial records are to your growth. Our bookkeeping services are built to give you clarity, consistency, and confidence when managing your day-to-day finances.

We help you stay on top of what you’re owed and what you need to pay. Our team tracks invoices, manages due dates, and ensures smooth cash flow with reliable transaction records.

We handle payroll from start to finish, from calculating wages and taxes to issuing payslips. Your staff are paid correctly and on time, every time, in line with local regulations.

We compare your financial records with your actual bank and card statements. This keeps your books accurate and helps catch issues early before they grow.

We make it easy for your team to submit, approve, and reimburse business expenses. Everything is logged, categorised, and tracked for clear and timely reporting.

We calculate, file, and manage your sales tax across states. You stay compliant with local tax laws as well as avoid penalties or late filings.

We track your business assets, from purchase to depreciation. Our records ensure you get accurate deductions and reports at tax time. It’s all part of our commitment to delivering top-tier business bookkeeping services.

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert serves U.S. foundations, charities, associations, and mission-driven organizat…

Finalert provides comprehensive accounting, cost management, and financial advisory ser…

Finalert delivers specialized accounting, tax planning, and financial advisory services…

Finalert provides specialized accounting and financial advisory services to U.S. media…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

No results available

At Finalert, we understand that your goals, challenges, and ambitions are unique, and so should be your bookkeeping. Our approach combines personalised service, modern tools, and clear communication. When you partner with us, you get a dedicated advisor focused on simplifying your finances and helping you grow with confidence.

We take time to understand how your business works, what you value, and where you’re heading. Our team designs custom bookkeeping solutions that match your goals and keep you moving forward.

Using the latest accounting software and automation tools, we make your processes faster and more reliable. Your financial data stays organised, accessible, and always up to date.

We believe you should never be left in the dark. You’ll receive regular updates and clear insights, so you can make timely, well-informed decisions without any guesswork.

Our service is built on precision and compliance. We maintain your records meticulously, ensuring they meet all state and federal regulations and hold up under scrutiny.

We see ourselves as part of your team. Whenever you have questions or need advice, you can count on us for prompt, friendly support — by phone, email, or video call. We’ve helped dozens of founders streamline their bookkeeping for startups in Ohio using cloud-based tools and proactive planning.

We take time to understand how your business works, what you value, and where you’re heading. Our team designs custom bookkeeping solutions that match your goals and keep you moving forward.

Using the latest accounting software and automation tools, we make your processes faster and more reliable. Your financial data stays organised, accessible, and always up to date.

We believe you should never be left in the dark. You’ll receive regular updates and clear insights, so you can make timely, well-informed decisions without any guesswork.

Our service is built on precision and compliance. We maintain your records meticulously, ensuring they meet all state and federal regulations and hold up under scrutiny.

We see ourselves as part of your team. Whenever you have questions or need advice, you can count on us for prompt, friendly support — by phone, email, or video call. We’ve helped dozens of founders streamline their bookkeeping for startups in Ohio using cloud-based tools and proactive planning.

Don’t take our word for it. Trust our customers

Finalert is an outstanding accounting, financial advisory and analytics company that delivers a wide range of services and solutions with the highest level of professionalism. Their expert team, with whom I have personally worked, possesses exceptional skills that enable customers to meet their financial and accounting needs seamlessly. Their dedication to excellence and customer satisfaction sets them apart, making them a trusted partner in the industry.

Finalert was hired to handle our payroll and pension administration. The process is extremely cost effective, and it has been extremely beneficial to us in terms of lowering our administrative costs and streamlining the payroll process.

For many years, as a medium-sized company, we had relied on a Big 4 firm to handle our audit and tax work. Following some service issues, it was decided to outsource that work to a local firm. I'm happy to report that the move has benefited us in terms of improved service and lower costs.

I have worked briefly with the Finalert team, who were tasked with cataloging validation rules for the ERP system. They did a very thorough job, ensuring the accuracy of information before implementing it. Additionally, their team was extremely responsive, often addressing any inquiries or requests within minutes. Their customer service skills are exceptional, and they were a pleasure to work with.

At Finalert, we know that business owners often have questions about how outsourcing bookkeeping and accounting services works. To help you better understand our services and how they can benefit your business, we’ve put together a list of frequently asked questions (FAQs). Our goal is to provide you with clear answers and the information you need to make informed decisions about your financial management.

Outsourcing your financial services saves you time and resources. It allows you to focus on running and growing your business without the complexities of managing in-house staff, staying compliant, or keeping up with tax regulations. Plus, you gain access to financial experts who can optimize your processes and deliver valuable insights.

We prioritize the security of your financial data by using top-tier accounting software and encryption technologies. Only authorized personnel have access to your data, and we follow strict protocols to ensure that your information is protected at all times.

Yes, we provide secure, cloud-based access to your financial data, allowing you to view your accounts, reports, and statements in real-time, anytime you need them. You stay informed and in control without managing day-to-day accounting tasks.

We generate monthly financial statements, but we can also provide custom reports based on your needs. This ensures that you always have up-to-date financial information for decision-making and compliance.

Our onboarding process begins with an initial consultation to assess your needs. From there, we set up your accounts, migrate your data to our systems, and establish workflows tailored to your business. The process is designed to be smooth and efficient, with minimal disruption to your operations.

No results available

Would you like to speak to one of our consulting manager over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.

Open Hours

Find Us on

New York Office

Open Hours

Find Us on

Ready to thrive? Connect with Finalert today and let’s succeed together in the dynamic global market.

© 2025 Finalert. All rights reserved.

Ready to grow with confidence and clarity?

Finalert delivers high-quality accounting, financial advisory, and analytics services tailored to growing businesses providing control, visibility, and decision-ready insight to support sustainable success.

Address

Our Services

Accounting Services

Advisory Services

Industries

Quick Links

© 2026 Finalert® LLC. All Rights Reserved.