Maximize revenue and streamline your sales cycle with Finalert’s Order to Cash (O2C) services. Our comprehensive solutions are designed to manage the entire process, from order management to cash realization, ensuring efficiency, accuracy, and compliance at every step.

For most businesses in the U.S., getting paid is as important as making the sale. Delays in order processing, invoice disputes, or poor follow-ups can all eat into cash flow and put strain on your operations. At Finalert, we help you gain control of your revenue cycle through our end-to-end order-to-cash outsourcing services designed to maximize speed, accuracy, and compliance.

We understand the U.S. market and its complexities, from fluctuating payment behaviors to tightening credit policies. With over a decade of consulting experience, we serve as your reliable order-to-cash strategy consultant, helping you reduce Days Sales Outstanding (DSO), enhance working capital, and strengthen customer relationships across industries.

We don’t just handle tasks. We build a revenue engine that runs with clarity, consistency, and care.

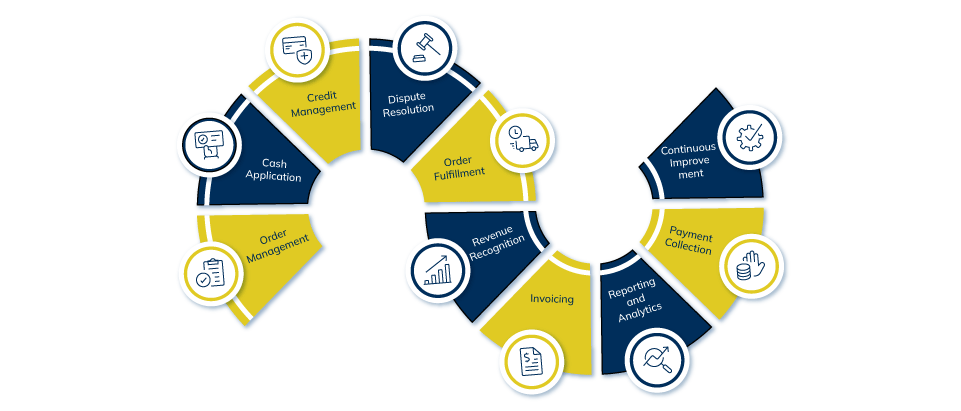

Order to Cash (O2C) is the full business process that starts with a customer placing an order and ends with your company receiving payment. It covers multiple interconnected steps: order management, credit checks, order fulfillment, invoicing, collections, payment reconciliation, dispute handling, and reporting.

In today’s fast-paced economy, each of these steps needs to be optimized to avoid revenue leakage, poor customer experiences, and delayed cash inflows. That’s why partnering with an experienced O2C solutions provider like Finalert makes business sense. We bring structure to the process, reduce errors, and ensure payments come in faster, without compromising compliance or customer satisfaction.

Our approach to O2C is structured, detailed, and performance-focused. Here’s how we break it down:

We use automated systems to receive, validate, and confirm orders in real time. This ensures fewer errors, no duplication, and complete transparency across departments. Your teams get accurate information from day one, enabling faster service and fewer delays.

Matching payments to the right invoices can be a nightmare when done manually. Our AI-based tools automatically apply payments to open invoices, reducing unapplied cash and improving financial accuracy.

We evaluate customer credit risk using smart analytics and historical behavior. By assessing the right financial indicators, we help you approve only creditworthy buyers and safeguard your receivables against defaults or long-term aging.

We identify the root causes of customer disputes and resolve them quickly through structured workflows. This minimizes escalations, improves customer trust, and keeps your collection timelines intact.

This step ties directly into your inventory and supply chain. Our team ensures smooth coordination between sales, inventory, and logistics so that products or services are delivered on time, every time. Late deliveries can mean late payments — we help prevent both.

We follow all relevant GAAP guidelines to ensure earned revenue is recorded correctly. This is crucial for audit readiness, compliance, and internal forecasting.

We generate clear, accurate, and timely invoices customized to your client’s preferences — whether that’s via email, EDI, or mail. This small step can make a big impact on DSO and customer satisfaction.

You get access to real-time dashboards that track metrics like DSO, cash inflow patterns, aging reports, and dispute trends. These insights help your finance leaders make better strategic decisions.

Our O2C collection management system sends automated reminders, follows up with tact and professionalism, and ensures faster turnarounds. We support multiple payment methods, giving your clients flexibility while keeping your cash flow steady.

We constantly monitor the O2C process for inefficiencies, delays, or system gaps. Our team works closely with yours to improve turnaround times, reduce friction, and support scalability as your business grows.

We use automated systems to receive, validate, and confirm orders in real time. This ensures fewer errors, no duplication, and complete transparency across departments. Your teams get accurate information from day one, enabling faster service and fewer delays.

Matching payments to the right invoices can be a nightmare when done manually. Our AI-based tools automatically apply payments to open invoices, reducing unapplied cash and improving financial accuracy.

We evaluate customer credit risk using smart analytics and historical behavior. By assessing the right financial indicators, we help you approve only creditworthy buyers and safeguard your receivables against defaults or long-term aging.

We identify the root causes of customer disputes and resolve them quickly through structured workflows. This minimizes escalations, improves customer trust, and keeps your collection timelines intact.

This step ties directly into your inventory and supply chain. Our team ensures smooth coordination between sales, inventory, and logistics so that products or services are delivered on time, every time. Late deliveries can mean late payments — we help prevent both.

We follow all relevant GAAP guidelines to ensure earned revenue is recorded correctly. This is crucial for audit readiness, compliance, and internal forecasting.

We generate clear, accurate, and timely invoices customized to your client’s preferences — whether that’s via email, EDI, or mail. This small step can make a big impact on DSO and customer satisfaction.

You get access to real-time dashboards that track metrics like DSO, cash inflow patterns, aging reports, and dispute trends. These insights help your finance leaders make better strategic decisions.

Our O2C collection management system sends automated reminders, follows up with tact and professionalism, and ensures faster turnarounds. We support multiple payment methods, giving your clients flexibility while keeping your cash flow steady.

We constantly monitor the O2C process for inefficiencies, delays, or system gaps. Our team works closely with yours to improve turnaround times, reduce friction, and support scalability as your business grows.

Finalert offers full-scope services that go beyond basic receivables. We align our work with your business model and long-term growth goals.

We manage the full lifecycle of every order — from intake to execution. Orders are tracked, validated, and updated using integrated software so your customers always know where things stand.

We help set and enforce credit policies that reduce exposure to bad debt. Our evaluations consider payment history, financial statements, and market behavior to make informed credit decisions.

Manual invoicing leads to delays and errors. We automate the entire process — from template creation to delivery — ensuring accurate and timely billing. This has helped some of our clients cut DSO by up to 30%.

We match payments to invoices quickly and precisely, flagging any mismatches or underpayments. This improves collection visibility and reduces back-and-forth between finance teams and customers.

We track, prioritize, and resolve customer complaints and discrepancies without damaging relationships. With transparent communication and accountability, disputes are handled before they impact cash flow.

Using historical payment data and predictive modeling, we deliver actionable reports on future cash flow. This enables better planning and supports investment decisions backed by real-time metrics.

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert serves U.S. foundations, charities, associations, and mission-driven organizat…

Finalert provides comprehensive accounting, cost management, and financial advisory ser…

Finalert delivers specialized accounting, tax planning, and financial advisory services…

Finalert provides specialized accounting and financial advisory services to U.S. media…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

No results available

Here’s what sets us apart from other providers:

We don’t believe in one-size-fits-all. Our solutions are customized around your customer experience, not just backend operations.

From automation to analytics, we bring in the best tools to improve efficiency at every step of the cycle.

By identifying credit risks, tracking dispute trends, and ensuring documentation accuracy, we help reduce your exposure to financial and operational risks.

We analyze every stage of your process, recommend changes, and help implement new workflows that save time and reduce effort.

Our dashboards give you meaningful insights, not just numbers. We help you act faster and more confidently.

You’ll have a U.S.-based account manager and O2C specialists available when you need them. From onboarding to optimization, we’re right there with you.

We don’t believe in one-size-fits-all. Our solutions are customized around your customer experience, not just backend operations.

From automation to analytics, we bring in the best tools to improve efficiency at every step of the cycle.

By identifying credit risks, tracking dispute trends, and ensuring documentation accuracy, we help reduce your exposure to financial and operational risks.

We analyze every stage of your process, recommend changes, and help implement new workflows that save time and reduce effort.

Our dashboards give you meaningful insights, not just numbers. We help you act faster and more confidently.

You’ll have a U.S.-based account manager and O2C specialists available when you need them. From onboarding to optimization, we’re right there with you.

Don’t take our word for it. Trust our customers

Finalert is an outstanding accounting, financial advisory and analytics company that delivers a wide range of services and solutions with the highest level of professionalism. Their expert team, with whom I have personally worked, possesses exceptional skills that enable customers to meet their financial and accounting needs seamlessly. Their dedication to excellence and customer satisfaction sets them apart, making them a trusted partner in the industry.

Finalert was hired to handle our payroll and pension administration. The process is extremely cost effective, and it has been extremely beneficial to us in terms of lowering our administrative costs and streamlining the payroll process.

For many years, as a medium-sized company, we had relied on a Big 4 firm to handle our audit and tax work. Following some service issues, it was decided to outsource that work to a local firm. I'm happy to report that the move has benefited us in terms of improved service and lower costs.

I have worked briefly with the Finalert team, who were tasked with cataloging validation rules for the ERP system. They did a very thorough job, ensuring the accuracy of information before implementing it. Additionally, their team was extremely responsive, often addressing any inquiries or requests within minutes. Their customer service skills are exceptional, and they were a pleasure to work with.

We’ve answered common questions about our Order to Cash (O2C) services to help you understand how we can optimize your sales cycle.

The Order to Cash business process covers the entire journey from when a customer places an order to when the payment is received and recorded. It includes steps like order management, credit checks, delivery, invoicing, collections, and cash application. At Finalert, we help streamline this process so businesses can accelerate cash flow, reduce errors, and boost customer satisfaction. By managing each stage with precision, we ensure every transaction is smooth, compliant, and optimized for better financial outcomes.

Finalert’s O2C (Order-to-Cash) services are designed to enhance your operational efficiency from order placement to cash realization. We analyze your existing order-to-cash process flow, automate key tasks, and plug inefficiencies with smart tools and proven methods. Whether it’s faster invoicing, smoother collections, or improved cash application, we tailor solutions to speed up your revenue cycle. Our focus is always on helping you improve liquidity, strengthen customer experience, and reduce order-to-payment turnaround with strategic automation and expert guidance.

Absolutely. Our O2C (Order-to-Cash) business process solutions are fully compatible with your existing ERP, CRM, and finance systems. We ensure seamless integration for real-time visibility, smoother data flow, and enhanced operational control. This connectivity eliminates silos between departments and allows for better coordination across the order to cash cycle. Finalert’s experts handle the technical aspects so you can focus on strategic decisions, knowing your financial processes are synchronized, accurate, and always up to date without overhauling your current tech stack.

O2C (Order-to-Cash) services are essential for industries with high-volume or complex transactions. At Finalert, we work with retail, logistics, manufacturing, and professional services businesses to optimize their cash cycles. By optimizing your O2C cycle, we help reduce revenue leakage and improve working capital. Regardless of your industry, if improving cash flow, shortening receivables timelines, and optimizing customer billing are priorities, Finalert provides the tailored solutions to get you there.

Getting started is simple. Reach out to us for a free consultation, where we assess your current workflows and explore areas for optimization. Our team will walk you through how our order-to-cash business process transformation can improve cash flow, eliminate inefficiencies, and deliver lasting value. Whether you’re starting fresh or looking to upgrade, Finalert provides end-to-end support, ensuring a smooth, customized onboarding experience that sets you up for long-term success.

No results available

Would you like to speak to one of our consulting manager over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.

Open Hours

Find Us on

New York Office

Open Hours

Find Us on

Ready to thrive? Connect with Finalert today and let’s succeed together in the dynamic global market.

© 2025 Finalert. All rights reserved.

Ready to grow with confidence and clarity?

Finalert delivers high-quality accounting, financial advisory, and analytics services tailored to growing businesses providing control, visibility, and decision-ready insight to support sustainable success.

Address

Our Services

Accounting Services

Advisory Services

Industries

Quick Links

© 2026 Finalert® LLC. All Rights Reserved.