From strong accounting foundations to strategic financial insight supporting sustainable growth at every stage.

Finalert supports businesses across SaaS and technology, nonprofits, healthcare, real estate, e-commerce, and financial services with industry-aligned expertise in Accounting, Advisory, and Analytics that drives clarity, ensures compliance, and supports sustainable growth.

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert serves U.S. foundations, charities, associations, and mission-driven organizat…

Finalert provides comprehensive accounting, cost management, and financial advisory ser…

Finalert delivers specialized accounting, tax planning, and financial advisory services…

Finalert provides specialized accounting and financial advisory services to U.S. media…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert provides specialized accounting, financial reporting, and advisory services to…

Finalert delivers specialized accounting, financial reporting, and advisory services to…

No results available

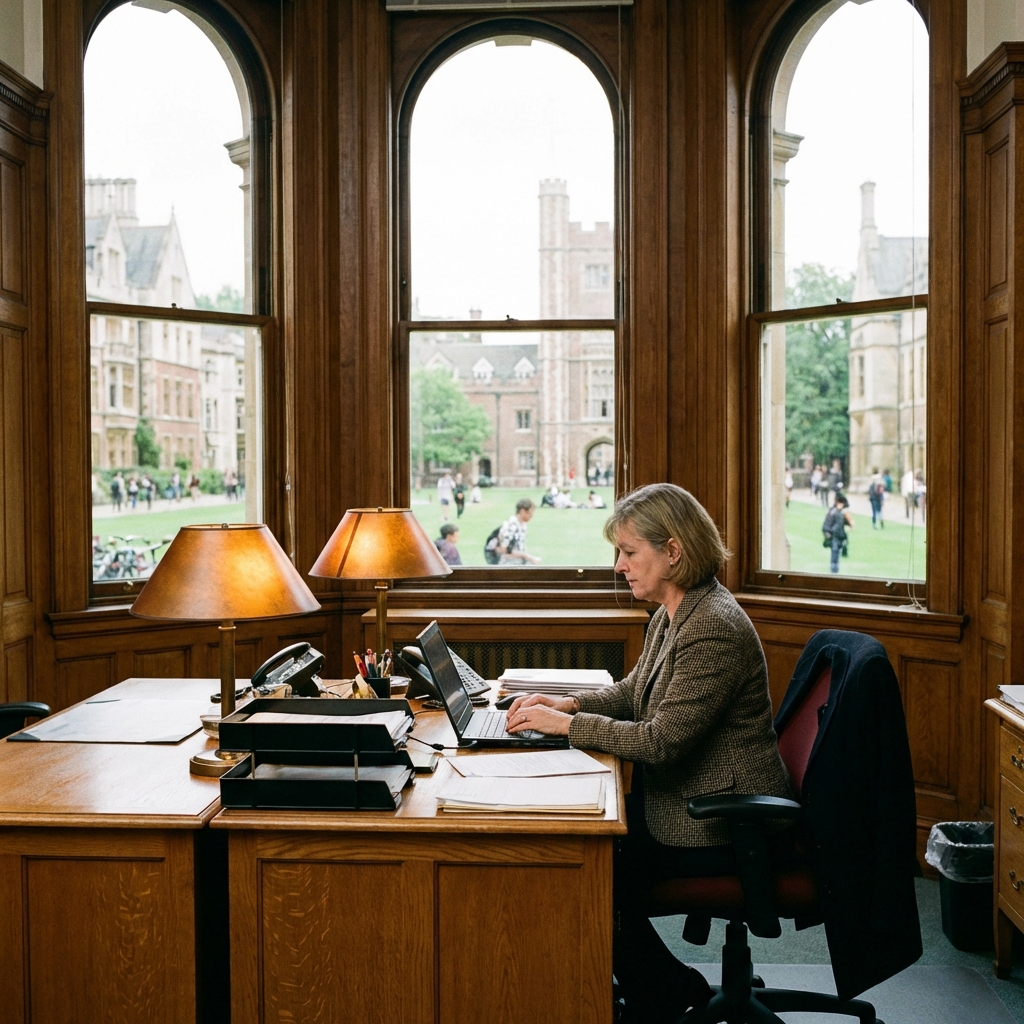

At Finalert, we deliver integrated accounting, financial advisory, and analytics services designed to support growing businesses. Our work focuses on building accurate, reliable financials, strengthening governance, and providing insight that enables confident decision-making. We partner closely with leadership teams to improve financial clarity, operational discipline, and long-term performance.

There are no results matching your search

There are no results matching your search

No results available

At Finalert, our clients’ success is our highest priority. From strengthening accounting performance to delivering insightful financial advisory, we help businesses across industries overcome challenges and achieve their strategic objectives. Explore our client stories to see how Finalert delivers tailored, high-impact solutions that create lasting results.

Would you like to speak to one of our consulting manager over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.

Ohio Office

1300 East, 9th Street

Suite 1210, Cleveland

OH 44114, United States

Open Hours

Find Us on

New York Office

800 Third Avenue

Suite 1105, New York

NY 10022, United States

Open Hours

Find Us on

Ready to thrive? Connect with Finalert today and let’s succeed together in the dynamic global market.

© 2025 Finalert. All rights reserved.

Ready to grow with confidence and clarity?

Finalert delivers high-quality accounting, financial advisory, and analytics services tailored to growing businesses providing control, visibility, and decision-ready insight to support sustainable success.

Address

Our Services

Accounting Services

Advisory Services

Industries

Quick Links

© 2026 Finalert® LLC. All Rights Reserved.